Role of MSMEs in Rural Employment Generation

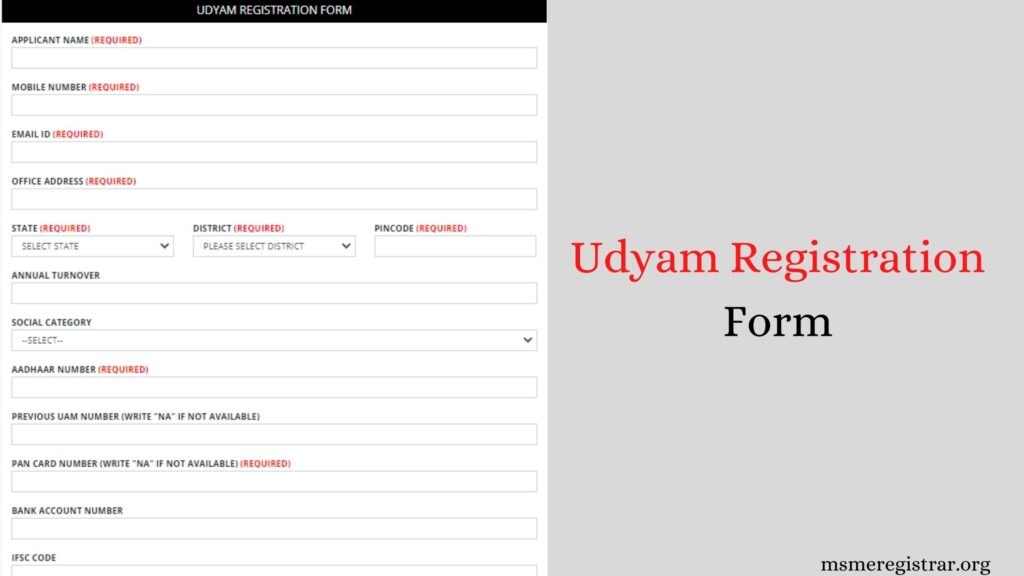

How do MSMEs contribute to rural employment in India? MSMEs significantly contribute to non-urban employment by offering diverse job opportunities beyond traditional agriculture. They help absorb underemployed labor in villages and provide livelihoods through small manufacturing, services, and trade. These enterprises utilize local resources and skills, making them highly suitable for remote contexts. Employment is generated not only directly through hiring but also indirectly through supply chains, logistics, and local services. MSME also encourage entrepreneurship among villagers by enabling small business ownership with low capital investment . As they often operate in labor-intensive sectors like textiles, food processing, and handicrafts, they serve as engines of inclusive economic growth in rural India. What types of MSMEs are most prevalent in rural areas? In village, MSMEs typically revolve around local strengths and resources. Agro-based industries such as food processing, dairy, and oil mills are common due to easy access to raw materials. Other prevalent MSMEs include handloom weaving, handicrafts, pottery, bamboo products, and coir-based manufacturing. These industries rely on traditional knowledge and manual skills, which are widely available in remote communities. Khadi and village industries, supported by institutions like KVIC, also play a major role. These enterprises often function as cottage or micro units, providing self-employment or engaging local workers on a small scale. Their low capital requirement and adaptability make them ideal for remote job creation. What government schemes support rural MSME employment? Several government schemes aim to promote rural employment through MSME development. The Prime Minister’s Employment Generation Programme (PMEGP) provides financial support to rural entrepreneurs for setting up micro-enterprises. MUDRA loans under the Pradhan Mantri Mudra Yojana offer easy access to credit for small businesses. Stand-Up India and Startup India promote inclusive entrepreneurship by supporting SC/ST and women entrepreneurs. Additionally, the SFURTI scheme supports cluster-based development of traditional industries. These programs also provide skill training, infrastructure development, and marketing support. By addressing key bottlenecks like finance and capacity building, these schemes help MSMEs grow and become sustainable sources of non-urban employment. What challenges do rural MSMEs face in creating jobs? MSMEs face several challenges that hinder their job creation potential. One major issue is inadequate infrastructure, such as poor road connectivity, unreliable electricity, and limited internet access, which affect production and logistics. Access to affordable credit remains difficult due to lack of collateral and formal documentation. There is also a shortage of skilled labor in areas, which limits productivity and quality output. Market access is another concern, as businesses struggle to compete in urban and global markets without proper marketing and branding support. Regulatory complexities and delayed approvals further deter small entrepreneurs. Addressing these barriers is essential for MSMEs to thrive and create employment. How can rural MSMEs be strengthened to boost employment generation? Strengthening remote MSMEs requires a multi-pronged approach involving infrastructure development, financial inclusion, skill enhancement, and policy support. Improving roads, power supply, and digital connectivity can enhance business operations. Access to low-interest credit through simplified lending norms is critical. Skill development programs tailored to industries will help increase workforce productivity. Promoting entrepreneurship through awareness campaigns and incubation centers can foster innovation. Encouraging MSME participation in e-commerce platforms and linking them with national and international markets will widen their reach. Government policies must focus on reducing compliance burdens and offering tax incentives to nurture a business-friendly environment in areas. In what ways do MSMEs help reduce rural-to-urban migration in India? MSMEs play a crucial role in reducing rural-to-urban migration by creating meaningful employment opportunities within rural areas. Many people migrate to cities due to the lack of stable income sources in villages. However, MSMEs provide alternative livelihoods by promoting local industries such as agro-processing, handicrafts, textiles, and small-scale manufacturing. These enterprises make use of locally available raw materials and traditional skills, ensuring employment without the need for relocation. By fostering entrepreneurship, MSMEs encourage self-employment and strengthen the local economy. Government schemes like PMEGP and MUDRA also support businesses financially, making it feasible for people to start and sustain small ventures at the village level. Additionally, cluster development programs enhance infrastructure and market access, allowing enterprises to thrive. When workers find reliable incomes close to home, the pressure to migrate decreases significantly. Thus, MSMEs contribute not only to employment generation but also to social stability by minimizing urban overcrowding and preserving communities.

Role of MSMEs in Rural Employment Generation Read More »