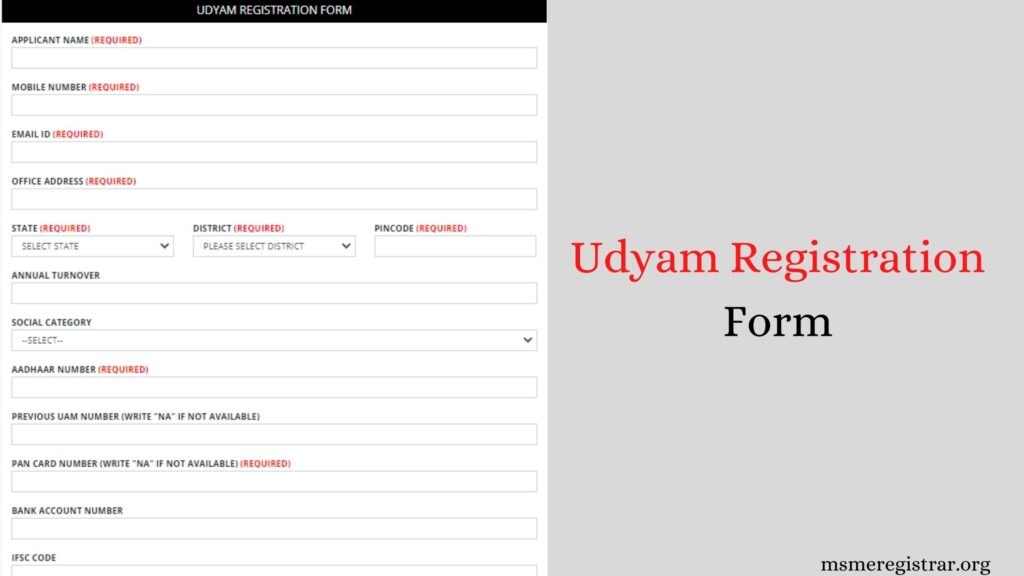

Availing a loan as an UDYAM registered MSME is relatively simple, as UDYAM registration opens the door to several financial schemes and easier access to loans with favorable terms. Below are the steps and important information on how to avail of a loan as an UDYAM registrant: 1. Identify the Right Loan Scheme UDYAM registration allows MSMEs to access various government-backed loan schemes, such as: 2. Visit Banks or Financial Institutions Banks and financial institutions offer loans to UDYAM-registered MSMEs under these government schemes. Some of the prominent banks that provide loans to UDYAM registrants include: Approach the bank where you already have a business account or any other bank that offers MSME loans. Many banks also have dedicated MSME loan departments. 3. Prepare Your Loan Application When applying for a loan, ensure you have the following documents ready: Note: Depending on the type of loan and the scheme, the required documents may vary. It is a good idea to contact the bank for a checklist of documents. 4. Submit Your Loan Application You can apply for a loan online via the bank’s website or visit the branch to submit the application. For government schemes like MUDRA Loans, you can apply online through the MUDRA portal. 5. Loan Processing and Approval Once your application is submitted, the bank will evaluate your business’s financial health, credit history, and your ability to repay the loan. The process may involve: The bank or financial institution may also ask for additional documents or clarifications during the review process. 6. Sanctioning of Loan If your loan is approved, the bank will issue a sanction letter detailing the loan amount, interest rate, tenure, and repayment schedule. Review these terms carefully before accepting. 7. Disbursement of Loan After you accept the loan offer, the funds will be disbursed to your business account. For some schemes, the disbursement may happen in stages depending on the nature of the loan (e.g., working capital, term loan). 8. Repayment Ensure you understand the repayment schedule. Repayments are generally monthly, and it is important to make timely payments to maintain a good credit score and ensure your business’s financial health. Key Government Schemes for MSME Loans: Here are a few major schemes under which UDYAM-registered MSMEs can avail loans: Additional Support: Conclusion: As an UDYAM-registered MSME, you can access a wide range of financial products tailored to your business needs. By choosing the right scheme and preparing the necessary documents, you can avail yourself of financial assistance for expansion, working capital, or other business needs. Loan for Documents If you’re asking about loans for documents or financial support for obtaining documents (such as required paperwork for loans), it might be helpful to clarify what you’re specifically referring to. However, based on the context, I can provide some insights related to financial documents and how to approach acquiring loans using those documents. 1. Documents Needed for Loan Applications To apply for a loan as an UDYAM-registered MSME, you’ll generally need several business and financial documents. These documents will help financial institutions assess your creditworthiness and the viability of your business. Here’s a list of typical documents required for MSME loan applications: 2. Loan for Document-Related Needs (e.g., Collateral or Property Papers) If you’re looking for a loan specifically for documents like for acquiring assets or property, the situation would be as follows: 3. Secured Loans vs. Unsecured Loans 4. Loan Processing 5. Government Schemes for MSME Loans If your query refers to obtaining a loan to cover some document-related expenses (for certifications or to establish a business legally), you might be able to use one of the government schemes designed for MSMEs: 6. Documents for Availing Loans: If you want to know how to get a loan by submitting documents, then follow these key points: UDYAM REGISTRATION MSME REGISTARTION MSME PRINT CERTIFICATE UDYAM REGISTARTION CERTIFICATE Loan form M Pocket with MSME / UDYAM REGISTRATION It seems like you’re referring to obtaining a loan from M Pocket with MSME registration. However, there isn’t a widely recognized lending institution or financial service called “M Pocket” directly associated with MSME loans. It’s possible that you may be referring to a mobile lending platform or a fintech app that offers loans to MSMEs. In India, there are several fintech companies and apps that provide easy access to loans for MSMEs. If you meant something else by M Pocket, feel free to clarify. That said, MSMEs can avail loans from various platforms, including digital lending platforms or traditional banks, that specifically cater to MSMEs. Types of Loans UDYAMEs Can Avail Through Digital Platforms: If you’re looking for a loan for your MSME through a mobile app or platform, here are some general options: 1. MUDRA Loans (PMMY) How to apply: Many banks like SBI, HDFC Bank, and fintech platforms like LendingKart or Capital Float allow you to apply for MUDRA loans online. 2. Loan Against Property (LAP) 3. CGTMSE (Credit Guarantee Fund Trust for Micro and Small Enterprises) 4. Working Capital Loans 5. Term Loans for UDYAMEs Steps to Avail Loans from Digital Platforms for UDYAMEs: Popular Digital Lending Platforms for UDYAMEs: Key Considerations for MSME Loans: Conclusion: If you’re referring to a loan for an MSME through a digital platform or “M Pocket”, there are many fintech apps that provide MSME loans with simple application processes and minimal documentation. Some well-known platforms like LendingKart, Capital Float, and Indifi specialize in MSME loans, so you can explore these options to get the funds you need for your business.