MSME UPDATE PROCEDURE,2025

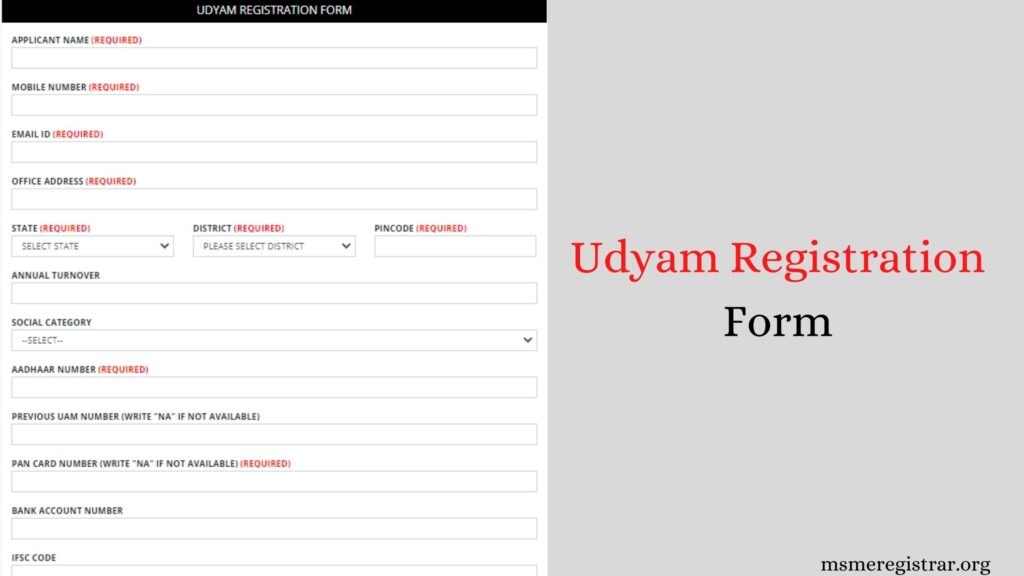

What does UDYAM stand for? MSME/UDYAM stands for Micro, Small, and Medium company. These are online msme updated businesses categorized based on certain criteria such as the investment made in plant and machinery or equipment, and the turnover they generate annually. The MSME plays a vital role in economic development, particularly in terms of employment generation, innovation, and supporting local industries. MSMEs contribute significantly to a country’s GDP and help diversify the economy. In India, MSMEs are defined based on their investment in plant and machinery or equipment and annual turnover. The classification ensures that businesses of varying sizes, from very small businesses to slightly larger enterprises, get support and recognition. The government of India has laid down clear criteria for classifying MSMEs into three categories: The MSME sector is critical in fostering entrepreneurship, reducing regional imbalances, and driving the export of goods and services. It is also a significant source of employment, especially in rural and semi-urban areas. The government provides various incentives, subsidies, and schemes to MSMEs to encourage their growth and development, which helps in scaling their businesses and improving their competitiveness in both local and international markets. Is registration mandatory for businesses in India? No, MSME registration is not mandatory for all businesses in India. However, there are significant advantages to registering a business as an MSME, which is why many entrepreneurs choose to do so. While MSME registration is optional, it is highly beneficial for businesses that want to take advantage of various government schemes, subsidies, and other incentives that are offered exclusively to MSMEs. Benefits of UDYAM Registration: What are the benefits of registering as UDYAM? Registering as an UDYAM offers various benefits, including: What documents are required for UDYAM registration in 2025? For MSME registration (specifically under the Udyam Registration portal), the documents required are: How has the UDYAM classification changed in the Union Budget 2025? In the Union Budget 2025, the classification criteria for UDYAMEs have been revised to make them more inclusive and supportive of growth. The key changes include: These updates aim to improve the ease of doing business and boost the growth of MSMEs, enabling them to contribute even more to the economy. udyog aadhar registration udyam certificate aadhar udyog msme certificate aadhar udyam udyam certificate download msme certificate download udyog aadhaar udyam register update udyam registration certificate update udyam certificate Update Msme certificate msme registration register msme udyam registration certificate download udyam registration udyam registration online udyam registration certificate

MSME UPDATE PROCEDURE,2025 Read More »