New Registration Process for MSME with Udyam Registration 2026

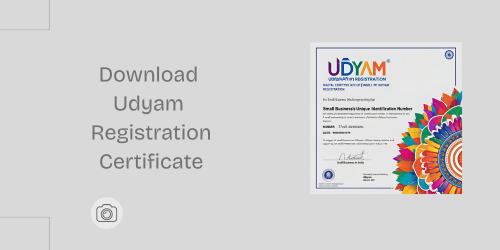

The Micro, Small, and Medium Enterprises (MSME) sector is the backbone of India’s economy, contributing significantly to employment generation and overall economic growth. Recognizing its importance, the government of India has implemented various initiatives to support and streamline the processes for MSMEs. One such initiative is the Udyam Registration, introduced in 2020 and updated in 2024 to further simplify and enhance the registration process for UDYAMEs. MSME Registration MSME is an online registration process for MSMEs, designed to replace the previous system of Udyog Aadhaar. The primary aim of this initiative is to provide a single-window, paperless, and hassle-free registration process, making it easier for businesses to avail themselves of various government schemes and benefits. Eligibility Criteria OF UDYAM As per the MSME classification, businesses are categorized based on their investment in plant and machinery or equipment and annual turnover. The revised criteria under Udyam Registration are as follows: Udyam Registration The Udyam Registration process has been further simplified in 2024 to enhance user experience and efficiency. Here’s a step-by-step guide to the new registration process: Benefits of Udyam Registration The Udyam Registration offers a plethora of benefits to UDYAMEs, which include: Conclusion The updated Udyam Registration process in 2024 marks a significant step towards enhancing the ease of doing business for MSMEs in India. By simplifying the registration process and integrating crucial databases, the government aims to provide a more conducive environment for the growth and development of the MSME sector. This initiative not only streamlines administrative procedures but also empowers small and medium enterprises to leverage various benefits, ensuring their sustainability and contribution to the Indian economy. udyog aadhar registration udyam certificate aadhar udyog msme certificate aadhar udyam udyam certificate download msme certificate download udyog aadhaar udyam register update udyam registration certificate update udyam certificate Update Msme certificate msme registration register msme udyam registration certificate download

New Registration Process for MSME with Udyam Registration 2026 Read More »